The Best Broker For Forex Trading PDFs

The Best Broker For Forex Trading PDFs

Blog Article

All About Best Broker For Forex Trading

Table of ContentsAbout Best Broker For Forex TradingSome Of Best Broker For Forex TradingThe 5-Second Trick For Best Broker For Forex TradingThe Greatest Guide To Best Broker For Forex TradingHow Best Broker For Forex Trading can Save You Time, Stress, and Money.

Given that Foreign exchange markets have such a large spread and are used by a massive variety of individuals, they provide high liquidity in comparison with other markets. The Foreign exchange trading market is continuously operating, and thanks to modern-day technology, comes from anywhere. Thus, liquidity refers to the reality that anyone can get or offer with a straightforward click of a switch.Therefore, there is always a possible store waiting to purchase or offer making Foreign exchange a fluid market. Cost volatility is just one of one of the most essential factors that aid choose the next trading action. For temporary Forex investors, cost volatility is vital, since it shows the hourly adjustments in an asset's worth.

For lasting capitalists when they trade Foreign exchange, the cost volatility of the market is also essential. An additional considerable benefit of Forex is hedging that can be used to your trading account.

How Best Broker For Forex Trading can Save You Time, Stress, and Money.

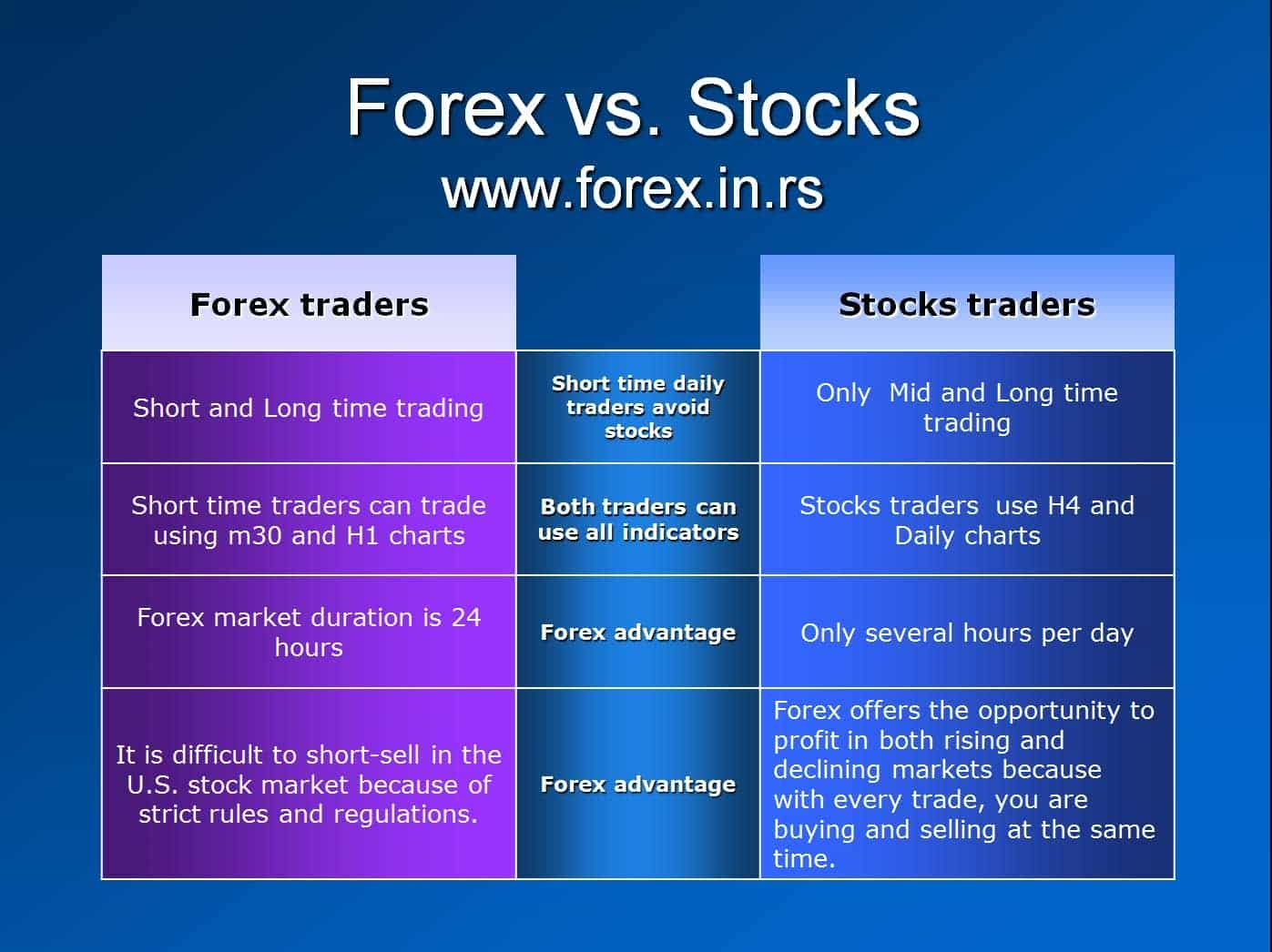

Depending on the time and effort, investors can be separated into categories according to their trading design. Several of them are the following: Foreign exchange trading can be efficiently applied in any of the strategies above. Additionally, as a result of the Forex market's wonderful quantity and its high liquidity, it's feasible to go into or leave the marketplace whenever.

Forex trading is a decentralized modern technology that functions with no central management. An international Forex broker should conform with the criteria that are specified by the Foreign exchange regulatory authority.

Hence, all the transactions can be made from anywhere, and considering that it is open 24 hr a day, it can likewise be done at any time of the day. If a capitalist is located in Europe, he can trade during North America hours and monitor the steps of the one money he is interested in.

Indicators on Best Broker For Forex Trading You Need To Know

In contrast with the supplies, Forex has extremely reduced purchase expenses. This is because brokers gain their returns through "Points in Percent" (pip). Most Forex brokers can supply a really low spread and reduce or also remove the trader's prices. Financiers that choose the Foreign exchange market can boost their earnings by staying clear of costs from exchanges, down payments, and other trading activities which have extra retail transaction prices in the supply market.

It offers the choice to go into the market with a little budget plan and profession with high-value money. Some investors might not satisfy the needs of high leverage at the end of the transaction.

Forex trading might have trading terms to protect the marketplace participants, yet there is the danger that a person might not value the agreed agreement. The Foreign exchange market functions 24 hr without stopping. Investors can not keep an eye on the changes daily, so they use algorithms to protect their interests and their investments. Therefore, they need to be regularly informed on exactly how the click to investigate technology functions, or else they might encounter excellent losses during the evening or on weekend breaks.

The larger those ups and downs are, the greater the rate volatility. Those big changes can dig this evoke a sense of unpredictability, and often traders consider them as a possibility for high earnings.

The smart Trick of Best Broker For Forex Trading That Nobody is Talking About

Several of the most volatile money sets are thought about to be the following: The Foreign exchange market offers a great deal of benefits to any type of Foreign exchange trader. Once having actually chosen to trade on forex, both skilled and newbies require to specify their economic technique and obtain aware of the terms and problems.

The content of this post mirrors the writer's opinion and does not always show the official placement of LiteFinance broker. The material released on this web page is offered informational purposes only and need to not be considered as the provision of financial investment guidance for the functions of Regulation 2014/65/EU. According to copyright regulation, this write-up is thought about intellectual building, which consists of a prohibition on copying and dispersing it without authorization.

If your firm does business globally, it's vital to understand exactly how the value of the U.S. dollar, relative to other money, can substantially impact the cost of products for united state importers and exporters.

What Does Best Broker For Forex Trading Do?

In the early 19th century, currency exchange was a major component of the procedures of Alex. Brown & Sons, the initial financial investment financial institution in the United States. The Bretton Woods Arrangement in 1944 needed currencies to be pegged to the United States buck, which was in turn fixed to the cost of gold.

Report this page